The trading floor buzzed with the familiar rhythm of finance screens alive with market data, models updating in real time, every number telling a story of risk and reward. You’d mastered the art of balancing budgets, forecasting trends, and turning raw data into decisions that moved millions. But somewhere in the back of your mind, a question kept surfacing:

“What if I could shape the product that drives these numbers, not just report them?”

That’s the moment the path from finance to product management starts appearing. You realize that the same analytical precision, risk assessment, and strategic vision that made you valuable in finance can make you unstoppable in product management. It’s not about abandoning your financial skill set; it’s about applying it where it can shape the engine of growth, not just track it.

Step out of the finance world and into the product room: sticky notes on the walls, prototypes on the table, engineers debating dependencies, and designers sketching flows. This is where your numbers meet narratives, where market forecasts turn into product roadmaps.

And this guide will show you exactly how to become a Product Manager with a Finance Background with confidence, clarity, and proof that you can build what you once only measured.

Why Your Finance Skills Set You Apart as a Product Manager?

Suppose you’ve been working in finance, whether it’s in Financial Planning and Analysis, audit, investment banking, or even as an analyst. You’ve already been doing some of the thinking that product managers do daily.

Here’s how.

You’re used to making sense of numbers. You take raw data and turn it into decisions. That’s a huge part of building products by knowing what’s working, what’s not, and what’s worth focusing on next.

You’ve also worked across teams, maybe with sales, legal, or operations, and had to explain things in a way others can understand. That kind of clear communication is gold in product roles, where you’re constantly syncing with engineers, designers, and business folks.

Another underrated skill you already have? Managing trade-offs. In finance, you’re constantly balancing risk vs. reward, cost vs. return. That’s exactly what PMs do when they decide which features to build and which ones to drop.

And if you’ve ever worked on tools or dashboards for internal teams, or helped shape pricing or business models, you’ve already touched product decisions – even if it didn’t feel like it.

The point is: you’re not coming in cold. You’ve been training for this all along – just from a different angle.

Key Takeaway: Numbers, trade-offs, clear communication, the skills you use daily in finance are the foundation of great product thinking.

Step-by-Step Guide to Transition from Finance to Product Management

Step 1 – Know the Role of a Product Manager

Product Managers are problem-solvers and decision-makers who guide cross-functional teams to deliver the right solutions. Think of them as mini-CEOs who may or may not have complete command over the company, but still lead cross-functional teams to get the right things built.

Here’s what they do on a daily basis:

- Define the problem: “What exactly are we solving and who is it for?”

- Prioritize: “Given limited time and tech bandwidth, what should we build first?”

- Write specs: Clear documentation for design and engineering to align on the solution.

- Collaborate with everyone: Engineers, designers, business teams, marketing, legal – PMs sit in the middle of it all.

- Measure outcomes: What success looks like isn’t a gut feeling – it’s defined by metrics and impact.

If you’re looking to become a product manager with a finance background, you’re already more prepared than you think. You’ve probably worked across functions, built business cases, and questioned assumptions. So all in all, you have a shared DNA with product managers.

Key Takeaway: PMs are decision-makers who bring people together to solve user problems. If you’ve ever balanced multiple teams or presented insights to leadership, you’ve been practicing the PM mindset.

Step 2- Skill Mapping: From Finance to Product Management

Making the leap from finance to product management isn’t about starting from zero – it’s about leveraging your existing strengths while building the new skills that PMs need every day. You already have the analytical foundation, business acumen, and cross-functional experience. Now, it’s time to reframe those skills in product terms and intentionally close the gaps.

1. Transferable Finance Skills for Product Management

Think of these as your “PM head start.” These skills are directly applicable to product management – they just need reframing.

- Financial Modeling to Product Impact Forecasting

In finance, you run models and scenarios to predict outcomes. In product, you forecast the potential business impact of a feature on revenue, churn, or retention. - Stakeholder Communication to Cross-Functional Alignment

You’ve worked with legal, compliance, and leadership. As a PM, you’ll partner with design, engineering, marketing, and QA to align on priorities. - Excel, Dashboards, Reports to Product Metrics & Analytics

Your ability to track, interpret, and present data is invaluable for measuring feature success, running A/B tests, and understanding user behavior. - Risk Management to Prioritization & Trade-offs

Finance trains you to weigh upside and downside. In product, this instinct helps you prioritize features and decide what not to build.

2. New Skills Finance Professionals Need to Learn for the Product Management Role

These are the product-specific capabilities that complement your finance background and complete your PM toolkit.

- User-Centered Thinking

Shift from focusing solely on the business to understanding user needs and pain points. Practice user interviews, review UX case studies, and shadow customer support. - Writing PRDs & User Stories

Move from board decks to product specifications. Learn to break features into user stories, define edge cases, and write PRDs. - Technical Fluency

You don’t need to code, but you must understand how software is built. Learn the basics of front-end vs back-end, APIs, and databases. - Product Strategy & Roadmaps

Apply your forecasting mindset to roadmaps that balance business goals, tech constraints, and user needs. Learn prioritization frameworks like RICE or MoSCoW. - Design & UX Basics

Understand design thinking, wireframes, and user flows. Familiarize yourself with tools like Figma to collaborate effectively with designers.

Learn Figma in under 50 minutes with this free masterclass!

So what should you do?

- Talk like a PM – Use product vocabulary: MVPs, trade-offs, roadmaps, metrics.

- Write like a PM – Document work using problem-to-solution to impact.

- Think like a PM – Always ask: Who’s the user? What problem are we solving? What does success look like?

- Upskill weekly – Pick one product skill and go deep until it feels natural.

By blending your finance strengths with these new product skills, you won’t just be someone from finance trying to break into product; you’ll be a business-minded PM who knows how to apply finance skills in product management, connecting the dots between numbers, strategy, and user impact.

Key Takeaway: You don’t need to start from scratch. Map your finance skills to product use cases, then focus on filling only the actual gaps, like UX thinking or writing PRDs.

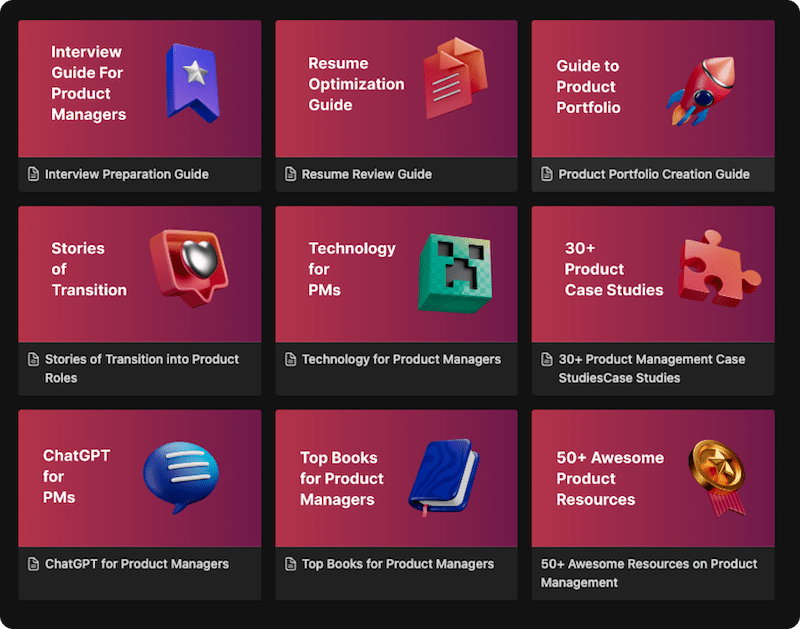

Want to get started right away?

You can check out the free product management resources to have a kickstart – from beginner-friendly guides and toolkits to practical templates that help you practice real PM skills before you land your first role.

Step 3– Give a Try to Product Management Courses

If you’re moving from finance to product management, think of a good course as your accelerator button. Sure, you could figure it all out on your own, but why spend months piecing things together when you can learn from people who’ve already been there?

A solid PM course should help you:

- Real PMs being your Mentor- Sure, anybody can teach the theories, but you need someone who has been in the field and that too for years. Mentors who have actually experienced and built something are the ones worth betting on!

- Get hands-on – look for courses that let you write actual PRDs, create roadmaps, and build MVPs instead of just reading about them.

- Get real feedback– Not the “looks fine” kind. You want constructive feedback from PMs who’ve shipped real products.

- Build your PM portfolio – Walk away with projects you can actually show recruiters, not just a certificate you’ll never open again.

- Practice interviews– So “How would you improve Spotify?” doesn’t make you freeze.

Key Takeaway

The thing here is to look for the courses that feel more like a workshop and less like a boring lecture. You want something interactive, with real projects, real feedback, and a little bit of “wow, I actually built that!” at the end.

And hey, if you’re curious about where AI fits into all this, my next AI Product Management course is floating around right now.

You can check it out, especially if PM + AI makes your ears perk up; it might be worth peeking at, just like you’d check out a new coffee place in your neighborhood!

Step 4 – Act Like a Product Manager Before You’re One

The magic of transitioning from finance to product management doesn’t happen the day you get a PM job offer.

It starts long before that, when you begin moving like a PM inside your current role – even if your LinkedIn still says “Finance Analyst.”

Within Your Finance Job

You already see where the numbers meet the product. Maybe you’ve spotted a pricing model that’s hurting retention, or a dashboard that could be ten times better if the product improved its data pipeline. These aren’t just “thoughts” – they’re product opportunities.

- Volunteer to help with internal tools, automation workflows, or anything that improves decision-making.

- Partner with product or ops to connect financial data to business impact.

Run a Side Project

Take a real problem – ideally one you care about – and solve it like a PM:

- Interview potential users

- Define the problem

- Draft a solution in Figma/Whimsical

- Share for feedback and iterate

Even a simple Notion doc walking through your decision-making process can become a solid portfolio piece, especially if you’re looking to start building your product manager portfolio with a finance background by showcasing how you turn data and business insights into product decisions.

Collaborate With Startups or NGOs

Early-stage teams often need help with dashboards, automation, or processes. Offer your finance expertise in exchange for shadowing product decisions.

Understand this, Product isn’t a title; it’s a way of thinking. The earlier you start showing it, the sooner the market will see you as one.

Key Takeaway

You don’t need the title to start the journey. Help build internal tools, run a side project, or shadow a PM. Proof of mindset > proof of title.

Step 5 – Turn Your Finance Work Into Product Management Proof-of-Work

Doing projects is good.

Turning them into a story that screams “I already think like a Product Manager”? That’s how you win interviews.

Learn From People Who’ve Made the Leap

Talk to PMs who came from finance, bootcamp alumni, or LinkedIn connections who’ve documented their journey. You’ll uncover:

- Common mistakes to avoid

- How they positioned their background

- What projects helped them stand out

Build a Product Management Portfolio That Feels Product-Ready

Curate projects that show you can spot problems, work cross-functionally, and deliver outcomes.

These are some things that you can include in your Portfolio

- Internal Tool Improvements – Automations, dashboards, reporting upgrades

- Product Teardowns – Analyse an app, highlight what works and what doesn’t

- Side Projects/MVPs – Budgeting tools, LTV trackers, finance dashboards

- Data-Backed Product Recommendations – Churn insights, pricing tweaks, retention strategies

- Course Projects/Mock PRDs – Clearly defined problems, trade-offs, and outcomes

Structure: Problem → Actions → Outcome → Skills → Visuals.

Host it on Notion, Google Slides, or a simple one-pager site, and link it everywhere – resume, LinkedIn, outreach messages.

Key Takeaway: Great portfolios don’t need code. Just show how you solve problems with structure and impact. Your dashboards, teardowns, and recommendations already count.

And hey, if you want to see exactly how to put one together without overcomplicating it, you can check out this product manager portfolio guide. Think of it as a shortcut, like getting the answer key to an open-book exam before you start.

Step 6 – Apply Strategically and Land the Right Product Manager Role

You’ve done the hard part – building skills, crafting proof-of-work, and learning the product language. Now it’s time to step into the arena. But this isn’t about hitting “Apply” on every PM job you see. It’s about playing a smart, targeted game.

Find Product Management Roles for Finance Professionals

Go beyond the generic PM listing and target:

- Fintech Product Manager – Payments, lending, wealthtech, regtech

- Product Analyst – Data-heavy entry point

- Internal Tools/Ops PM – Roles focused on workflow and efficiency

- Platform/Billing PM – Overlaps heavily with finance and systems knowledge

Search using titles like “Payments PM,” “Risk Product Manager,” or “Product Analyst – Fintech” to find better matches.

Craft a Product Manager Resume That Connects the Dots

Show product impact from finance work:

- “Built forecasting model” → “Built forecasting model that informed product pricing update, cutting churn by 12%.” Use PM keywords like roadmap, MVP, prioritization, user metrics, and cross-functional alignment.

Prepare for Product Management Interviews With Intention

Expect a mix of:

- Product Thinking: Use CIRCLES/JTBD for design questions.

- Metrics & Execution: Bring in your finance edge for ROI and trade-offs.

- Behavioral: Use STAR to show influence, collaboration, and impact.

Do take-home assignments and whiteboarding with a peer. Be clear about assumptions, trade-offs, and priorities – that’s what they want to see.

Network While You Apply

Engage with PMs, fintech founders, and hiring managers. Comment meaningfully, send warm DMs when roles open, and use your portfolio as a conversation starter.

Follow Up Like a Human

After interviews, send thank-you notes with a specific takeaway from the conversation. If you submitted an assignment, share your thought process – even if the solution wasn’t perfect.\

Key Takeaway: Don’t spray and pray. Apply where your finance background is a superpower — fintech, billing, analytics, or ops-heavy PM roles.

Free Product Management Interview Preparation Playlist

Before you go, unlock our Free Product Management Interview Preparation Playlist. It’s your no-cost crash course for PM Interview prep.

My Last Two Cents

Transitioning from finance to product isn’t a cliff jump – it’s a slow, deliberate climb, one well-placed step at a time. Some days the progress will be loud – publishing your first product teardown, rewriting a finance project into a case study, landing a coffee chat with a fintech PM who sees the spark in your story. Other days, it’s quieter – tinkering with a PRD draft, sketching a feature idea in Figma, or adding another “aha” to your PM vocabulary.

Each of those moments is evidence that you’re moving forward. You’re not starting from scratch – you’re compounding on a portfolio of skills: analytical discipline, business acumen, and the strategic instinct to see the numbers behind every decision. That’s your edge.

And just like a seasoned investor, you’re not chasing quick wins – you’re betting on the long-term value you can create. So keep iterating. Write that sample PRD. Ask the hard “why” questions. Jump into a PM community. Keep showing up, even when it feels small, because every step is building the version of you who will walk into that product role with quiet confidence.

FAQ’s

Yes, absolutely. Many successful PMs come from non-technical backgrounds like finance, consulting, or operations. While understanding basic tech concepts helps, your strengths in analysis, strategic thinking, and stakeholder management are just as important.

Roles like Fintech Product Manager, Associate Product Manager, Internal Tools PM, or Risk/Platform PM are ideal. They value your strengths in data analysis, business strategy, and financial systems. These positions let you apply your finance knowledge while learning the product side.

No, an MBA is not mandatory. While it can help with networking or pivoting, many finance professionals transition without one by showcasing relevant skills, building a portfolio, and networking strategically.

Startups often offer more flexibility and ownership, making them great entry points. However, larger companies may have Associate PM programs or internal transitions. Apply to both but tailor your approach for each.

Yes, many PMs come from finance backgrounds. Your skills in analysis, strategy, and stakeholder management are highly valuable, especially in fintech or data-driven product roles.

WATCH HELLOPM COHORT IN ACTION

WATCH HELLOPM COHORT IN ACTION