Fintech Product Management involves overseeing the lifecycle of a financial technology product. Product managers guide the development, launch, and continuous improvement of fintech products. They ensure that these offerings not only meet but exceed user expectations. The offerings align with business goals. They do this by identifying customer needs and market gaps.

India – A Global FinTech Superpower

According to a report by Invest India

India is amongst the fastest growing Fintech markets in the world. Indian FinTech industry’s market size is $50 Bn in 2021 and is estimated at ~$150 Bn by 2025.

- India has the highest FinTech adoption rate globally of 87% which is significantly higher than the Global average rate of 64%.

- The Indian Fintech industry’s Total Addressable Market is estimated to be $1.3 Tn by 2025 and Assets Under Management & Revenue to be $1 Tn and $200 Bn by 2030, respectively

- The Payments landscape in India is expected to reach $100 Tn in transaction volume and $50 Bn in terms of revenue by 2030.

- India’s digital lending market was worth $270 Bn in 2022 and is expected to reach $350 Bn by 2023.

- India is the 2nd largest Insurtech market in Asia-Pacific and is expected to grow by ~15X to reach $88.4 Bn by 2030; India is poised to emerge as one of the fastest-growing insurance markets in the world.

- The Indian WealthTech market is expected to grow to $237 Bn by 2030 on the back of a growing base of retail investors.

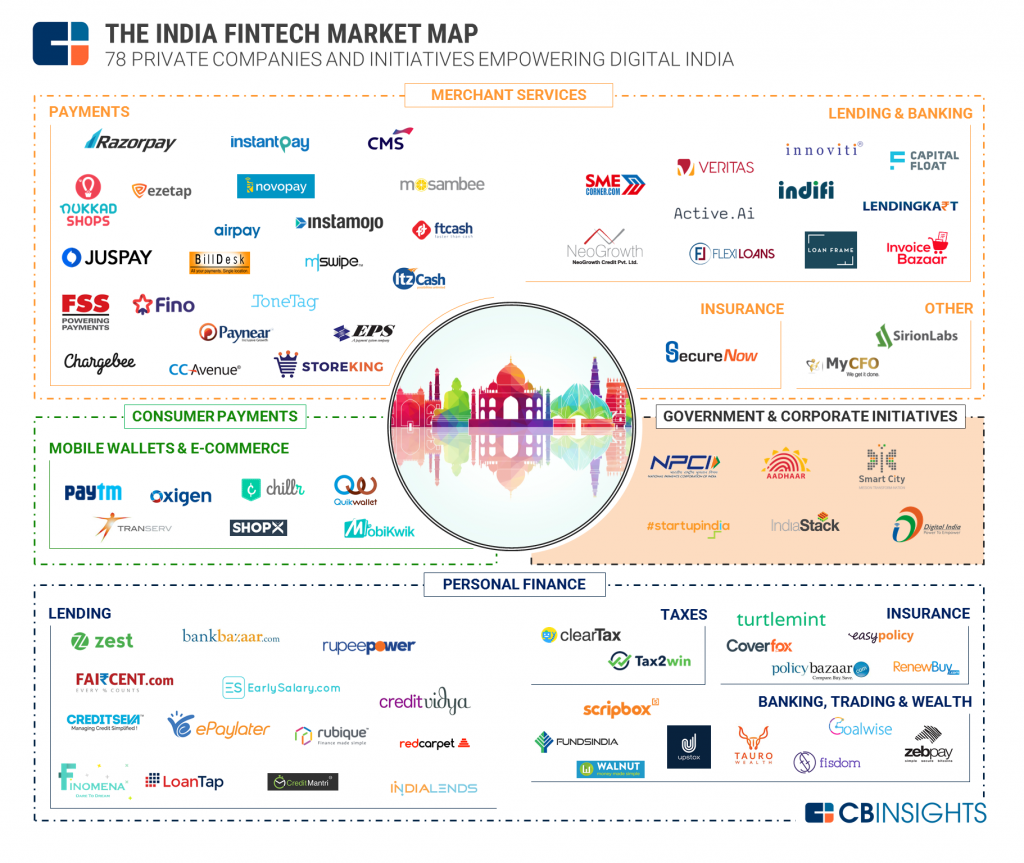

Top Names in Fintech Space in India

India’s fintech landscape is vibrant. Many startups and established companies are making significant impacts. Let us look at some top sectors in this space

WealthTech: This sector focuses on technology that democratizes investment and wealth management, making these services accessible to a broader audience. An example is Zerodha, a pioneer in this space, which has simplified equity trading and investment for the average consumer.

InsureTech: InsureTech companies are transforming the insurance industry by using technology to streamline the process of buying insurance, making claims, and managing policies. PolicyBazaar stands out in this sector by offering a platform where users can compare and purchase various insurance policies, making the process transparent and user-friendly.

Payments and Transfers: This includes companies that facilitate digital transactions, making payments seamless and secure. Paytm and PhonePe are leading players here, offering a wide array of financial services from digital wallets to payment systems.

LendingTech: Fintech firms in this sector aim to simplify the borrowing process, offering more accessible loan options and quicker approval processes. LendingKart is an example, providing small and medium-sized businesses with easy access to capital without the need for collateral.

RegTech: Standing for ‘Regulatory Technology’, this sector focuses on solutions that help financial service firms comply with regulations efficiently. ClearTax is an example of simplifying tax filing and compliance for individuals and businesses.

Personal Finance Management: These platforms help individuals manage their finances, track spending, and plan budgets. CRED innovates in this space by rewarding users for good financial behaviour, like timely credit card bill payments.

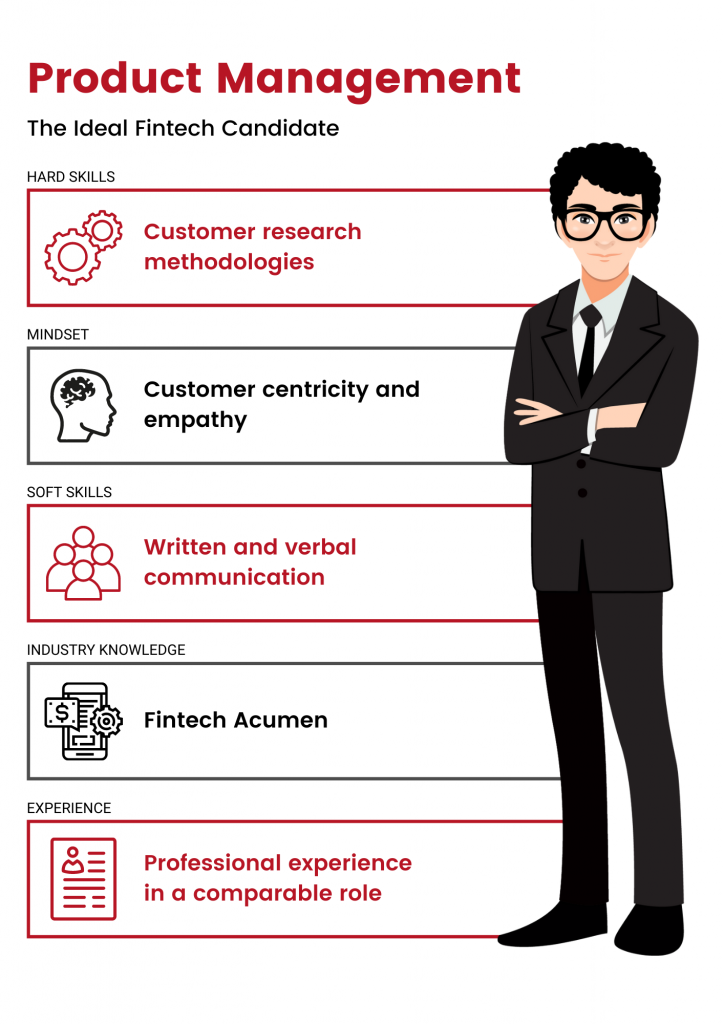

Essential Skills for a Fintech PM

1. Regulatory Knowledge and Compliance

The financial industry is among the most heavily regulated sectors globally. A deep understanding of the regulatory landscape is therefore not just beneficial but essential for a Fintech PM. This knowledge helps in navigating the complex web of compliance requirements, which can vary significantly by region and product type. Moreover, with regulations constantly evolving in response to new technologies and market trends, a proactive approach to compliance can become a competitive advantage, enabling faster market entry and reduced legal risk.

2. Agile and Lean Methodologies

Agility and efficiency are at the heart of successful FinTech product management. Familiarity with agile and lean methodologies empowers PMs to respond swiftly to market changes, user feedback, and internal challenges.

By embedding these principles into their product development process, PMs can create a culture of continuous improvement and innovation.

3. Customer-Centric Innovation

Innovation in fintech is not just about leveraging the latest technologies but about solving real problems for real people. A customer-centric approach to innovation requires a deep empathy for the user, and an understanding of their financial goals, challenges, and behaviors. It’s about looking beyond the conventional wisdom of the industry to find novel solutions that make financial management more accessible, intuitive, and empowering for everyone.

4. Risk Management

The stakes are inherently high in the fintech industry, where products often handle sensitive financial data and transactions. A solid grasp of risk management principles is crucial for identifying potential threats to the security, reliability, and integrity of a FinTech product. A proactive, comprehensive approach to risk management can protect users and the company, preserving trust and ensuring long-term success.

5. Cross-Functional Leadership

The role of a Fintech PM is inherently cross-disciplinary, requiring effective collaboration across diverse teams, from engineering and design to marketing and finance. Strong leadership skills enable a PM to align these varied perspectives around a shared vision, fostering an environment where innovation thrives. This involves not only managing projects and timelines but also inspiring and motivating team members, resolving conflicts, and driving strategic initiatives forward.

6. Digital Marketing and Growth Hacking

In a competitive landscape, the ability to effectively market a fintech product can be the difference between its success and failure. Digital marketing and growth hacking skills help PMs understand their market, identify target audiences, and craft compelling value propositions. This involves a blend of creativity and analytics, using data-driven strategies to optimize user acquisition, retention, and engagement, ultimately driving sustainable growth.

7. Ethical Considerations and Social Impact

Fintech products have the power to transform lives by providing greater access to financial services, improving financial literacy, and fostering economic inclusion. With this power comes a responsibility to consider the ethical implications and social impact of product decisions.

This requires a thoughtful approach to design, a commitment to transparency, and a dedication to fairness, ensuring that the benefits of fintech innovations are accessible and equitable.

8. Data-Driven Decision-Making

In the era of big data, the ability to make informed decisions based on quantitative analysis is important. For a Fintech PM, this means not only having the skills to gather and interpret data but also the wisdom to know which metrics matter most.

Mastery of data analytics enables PMs to validate hypotheses, prioritize features based on real user needs, and continually refine their product to better serve the market.

How to be a Fintech PM: A Step-by-Step Guide

Step 1: Lay the Foundation with Industry Knowledge

- Begin with “Digital Bank” by Chris Skinner for an overview of digital banking’s evolution.

- “The Innovator’s Dilemma” by Clayton M. Christensen provides insights. It shows how disruptive technologies can redefine markets.

- Deepen your understanding of startup methodologies with “The Lean Startup” by Eric Ries.

- Explore “Zero to One” by Peter Thiel for insights into creating unique tech businesses.

- “Bank 4.0” by Brett King offers a glimpse into the future of banking.

- Subscribe to the Finextra Daily newsletter and Finshots to keep abreast of the latest developments in the fintech sector.

Step 2: Develop Essential Skills for Fintech Product Management

- Dive into “Blockchain Basics” to understand this pivotal technology in fintech.

- Brush up on financial concepts. Take courses like “Finance for Non-Finance Professionals“. This will help you navigate the fintech ecosystem effectively.

Step 3: Network and Engage with the Fintech Community

- Contact experienced Fintech Product Managers on LinkedIn. They can provide insights and potential mentorship.

- Join fintech communities and forums. You can find them in specific LinkedIn groups or platforms like FinTech Alliance. Doing so will keep you engaged with the latest industry trends.

Step 4: Gain Hands-On Experience

- Develop a fintech-related project. For example, create a budgeting tool prototype. This will help you apply your learning practically. Tools like Figma can be instrumental in designing your prototype.

- Contribute to or initiate open-source fintech projects on platforms like GitHub. You will gain real-world experience.

- Engage in fintech hackathons. They are a great way to apply your skills. You can also innovate, and meet like-minded individuals and potential collaborators.

Step 5: Master the Job Application Process

Craft a Compelling Resume

- Utilize resources like “Knock ‘Em Dead Resumes” to create a resume that stands out.

- Prepare for PM interviews with “Cracking the PM Interview” by Gayle Laakmann McDowell. This book will help you navigate the interview process for product management roles.

Target Emerging Startups

- Focus your job search on emerging fintech startups. Here, you can have a significant impact and find ample growth opportunities.

Step 6: Commit to Continuous Learning

Pursue Advanced Studies

- Consider enrolling in advanced programs. For example, you could take the “Professional Certificate in Fintech” from prestigious institutions like MIT Sloan. This will deepen your fintech expertise.

- Listen to podcasts like “How I Built This” and “Masters of Scale” to gain insights into entrepreneurship and product innovation.

- Explore new developments, technologies, and business models within the fintech domain to stay ahead in your career.

Understanding Fintech PM Salaries in India

Fintech Product Managers in India is part of a rapidly growing industry. Their compensation packages reflect the critical role they play. They drive innovation and product success. Salaries can vary significantly based on several factors:

1. Experience Level

- Entry-Level: Freshers or those with limited experience (up to 3 years) might start with salaries ranging from INR 10 to 12 lakhs per annum. At this stage, PMs are expected to handle smaller products or features and work closely under the guidance of senior PMs.

- Mid-Level: With 4 to 8 years of experience, PMs can expect to earn between INR 20 to 30 lakhs per annum. They usually have ownership of significant product lines or multiple features and might lead a team of junior PMs and analysts.

- Senior-Level: Experienced PMs with over 9 years of experience. Especially those with a successful track record of product launches and management. They can command salaries upwards of INR 30 lakhs. Those in leadership positions or working with top-tier firms. They can potentially make 50 lakhs or more.

2. Company Size and Funding

- Startups: Early-stage startups might offer lower base salaries. They compensate with equity or stock options, which could be lucrative in the long run if the company grows significantly.

- Established Fintech Firms: Larger, well-funded fintech companies usually offer competitive salaries. They also provide benefits like bonuses and health insurance.

3. Location

- Fintech PM salaries can also vary based on the city. Tech hubs, like Bangalore, Mumbai, and Gurgaon, usually offer higher salaries. This is because of the high cost of living and the concentration of fintech companies.

4. Skill Set and Specialization

- Product Managers might earn more if they have specialized skills in high-demand areas like blockchain, AI/ML applications in finance, and cybersecurity. This is due to the niche expertise required.

5. Educational Background

- A strong educational background can significantly influence starting salaries and growth prospects. This is especially true with degrees from reputed institutions or specialized fintech certifications.

Opportunities in FinTech Industry in 2024

1. Digital Payments Expansion

India’s digital infrastructure is continuously improving. Digital payments are set to penetrate deeper into rural and semi-urban areas. This expansion presents a ripe opportunity for fintech PMs to innovate. They can cater to a broader audience with localized solutions.

2. Blockchain and Cryptocurrency

Despite regulatory hurdles, blockchain technology and cryptocurrencies are gaining traction. Decentralized finance (DeFi) and secure transactions have the potential to open new avenues for product innovation. This is particularly true in remittances, lending, and asset management.

3. AI and ML Integration

Artificial Intelligence and Machine Learning continue to revolutionize fintech products. They offer personalized banking experiences and advanced fraud detection systems. Fintech PMs have the opportunity to lead projects that leverage these technologies. They can offer smarter, more intuitive financial solutions.

4. Financial Inclusion

A significant portion of India’s population remains unbanked or underbanked. Fintech products aimed at financial inclusion can make a substantial impact. They offer basic banking services, microloans, and insurance products. These are tailored to the needs of these segments.

5. RegTech Solutions

Financial regulations are becoming more complex. There’s a growing demand for RegTech (Regulatory Technology) solutions. These tools help businesses follow regulations efficiently and cost-effectively. They represent a growing niche for fintech PMs.

Challenges for FinTech Industry in 2024

1. Regulatory Landscape

Navigating India’s regulatory environment remains a challenge. Policies around digital currencies, payment systems, and fintech licenses are continuously evolving. Staying compliant while innovating will be a key challenge for fintech PMs.

2. Cybersecurity Threats

Fintech solutions are becoming more integrated into daily financial activities. As a result, the risk of cyber threats increases. Ensuring robust security measures will be crucial. Maintaining customer trust in the face of potential breaches is also important.

3. Intense Competition

India has a crowded fintech space. Many startups are vying for market share. Traditional banks are also expanding their digital offerings. Standing out in this competitive landscape requires innovative solutions and clear value propositions.

4. Technological Disruption

Keeping pace with rapid technological advancements is a challenge. Fintech PMs must learn and adapt to new technologies. These include things like quantum computing, IoT in banking, and advancements in blockchain. This keeps them ahead.

5. User Experience and Retention

Designing fintech products is a challenge. They must be not only functional but also engaging and easy to use. This is especially true for diverse Indian demographics. Balancing simplicity with functionality to enhance user experience and retention is key.

Conclusion

Fintech Product Management in India is witnessing exponential growth, with the country emerging as a global leader in the field. The key takeaway is the tremendous opportunity this presents for fintech product managers to innovate and drive meaningful change. With a rapidly expanding market and high adoption rates, there’s a pressing need for PMs to possess a diverse skill set. From regulatory knowledge to agile methodologies, customer-centric innovation, and data-driven decision-making, PMs must navigate various challenges such as regulatory complexities, cybersecurity threats, and intense competition. However, by staying abreast of industry trends, fostering cross-functional collaboration, and prioritizing user experience, fintech PMs can leverage these challenges as opportunities for growth and continue to drive the industry forward.

WATCH HELLOPM COHORT IN ACTION

WATCH HELLOPM COHORT IN ACTION